The Boeing Company (BA)

Industry: Aerospace and Defense

Current Dividend Yield: 2.9%

The Boeing Company is the world’s largest aerospace and defense company. It operates worldwide and is the largest exporter in the United States. Its three main divisions are Commercial Airline, Integrated Defense Systems, and Boeing Capital.

Business Segments:

Commercial Airplanes: 50%

From the iconic 747 to the all-new 787 Dreamliner, Boeing delivers a family of technologically advanced and efficient airplanes to customers around the world.[1] With a global aerospace refresh starting anew, Boeing can expect to see an increase in demand for its planes in the coming quarters. In fact, Boeing has recently received one of its largest orders to date from American Airlines. Boeing did split this order with is closest competitor, EADS NV (EADSY) but if we take management's word for it, they simply couldn’t produce enough planes to fill the order by themselves.

Integrated Defense Systems: 50%

Boeing is a recognized leader in providing and supporting large-scale systems that combine sophisticated communications networks with air-, land-, sea- and space-based platforms for military, government and commercial customers around the world.

Key IDS products are: fighter jets, rotocraft, large aircraft, missiles/bombs, satellites, communication systems, space systems and launch systems

Investors have recently been concerned with the U.S government’s contraction in defense spending. I acknowledge this is a legitimate concern, however it's not one that I am losing sleep over. The fact of the matter is that America is perpetually at war. This is not a political statement. It is what it is.

Let’s take a look at Boeing's fundamentals’:

With cyclical companies such as Boeing, it’s important to not get caught up with 7-year averages and ratios. Even with Boeing’s cyclicality, its 7-year ROE is a respectable 14.6%. Additionally, it is trading at a considerable discount to its historic P/E. Read the rest of the article here.

Monday, August 22, 2011

Sunday, August 14, 2011

Best in Breed Dividend Stocks: Portfolio Check Up

Over the last week I received numerous emails regarding my last column on Seeking Alpha. Readers inquired why I was so negative on the market. Other than the macro elements that I laid out, the market had set itself up for a psychological correction.

Generally speaking, I am a firm believer in the efficient market theory. I believe most equities trade at, or near, their true market value. There is little to no money to be made when equities are fairly valued. Alpha becomes harder and harder to come by.

When markets are in a sustained uptrend, as we witnessed throughout the duration of QE2, they begin to trade with a sense of invincibility. We forget to worry or factor in risk. Riskier assets simply become conduits to greater returns. With the Bernanke ‘put’ in place, there was no downside risk. The only way to generate alpha was to chase greater risk. When this occurs, the efficient market theory quickly devolves into the ‘castle in the air’ theory, or more aptly, the ‘greater fool’ theory.

All equities begin to trade at multiples that are unwarranted, limiting upside while exacerbating downside risk. Who was buying Open Table (OPEN), Salesforce (CRM) and Netflix (NFLX) at these multiples? I guess there is always a greater fool waiting to carry your bag, so why worry?

Eventually this over exuberance comes to end. In our recent scenario, Bernanke took off the training wheels and we had the sudden realization that the US economy was not ready to ride on its own. We careened off the edge at full speed. Selling begets selling, and the market became increasingly irrational. Risk begins to rear its ugly head and the weak retreat to the security of their bank accounts.

This is capitulation. This is purely psychological, and it’s exactly the time to purchase equities. This is when real money is made.

Read the rest of the article here

Generally speaking, I am a firm believer in the efficient market theory. I believe most equities trade at, or near, their true market value. There is little to no money to be made when equities are fairly valued. Alpha becomes harder and harder to come by.

When markets are in a sustained uptrend, as we witnessed throughout the duration of QE2, they begin to trade with a sense of invincibility. We forget to worry or factor in risk. Riskier assets simply become conduits to greater returns. With the Bernanke ‘put’ in place, there was no downside risk. The only way to generate alpha was to chase greater risk. When this occurs, the efficient market theory quickly devolves into the ‘castle in the air’ theory, or more aptly, the ‘greater fool’ theory.

All equities begin to trade at multiples that are unwarranted, limiting upside while exacerbating downside risk. Who was buying Open Table (OPEN), Salesforce (CRM) and Netflix (NFLX) at these multiples? I guess there is always a greater fool waiting to carry your bag, so why worry?

Eventually this over exuberance comes to end. In our recent scenario, Bernanke took off the training wheels and we had the sudden realization that the US economy was not ready to ride on its own. We careened off the edge at full speed. Selling begets selling, and the market became increasingly irrational. Risk begins to rear its ugly head and the weak retreat to the security of their bank accounts.

This is capitulation. This is purely psychological, and it’s exactly the time to purchase equities. This is when real money is made.

Read the rest of the article here

Monday, August 8, 2011

T20YM: Time to Pick Em'

It’s been over six months since I penned my Best in Breed Dividend Stock series for Seeking Alpha. For the majority of that time, the markets have been on an unsustainable trend upwards. I have refrained from writing individual analyses as I simply did not trust the multiples being awarded to equities. I couldn’t bring myself to recommend stocks at such lofty levels. Lucky for us, there was the end of July and first week of August …

Pardon me while I chuckle.

How did you not see this coming? Let’s break down just some of market headwinds we have seen over the last two months; the end of QE2, lingering effects of the Japanese earthquake and tsunami, a growing European sovereign debt crisis, and increasingly negative U.S. economic data points. Just how bad were those U.S data points? How about a Q1 GDP revision down to .4% and Q2 GDP coming in at whopping 1.3%? Let’s not forget the July ISM number plummeting to 50.9%, its lowest reading since August of 2009. Sprinkle in some truly dreadful employment numbers and you have a surefire recipe for disaster. Anyone who is blaming this on the debt ceiling debate is fooling themselves. There’s a reason companies are sitting on oodles of cash and not hiring. There’s a reason why companies have been conservative with their Q3 guidance. The world’s economy is slowing down. We need to accept this as fact and allocate capital accordingly.

So with all that doom and gloom how can I possibly recommend investing in equities? Look, things are bad, but the world is not ending. Even if we slip into another recession, the S&P doesn’t need to trade down to 900. Companies are still making money and equities are the only investment with any chance of generating alpha. This correction has brought stocks back to reality. I still don’t think stocks are cheap but at these levels I am willing to put some money to work.

Check out the stocks I selected here

Pardon me while I chuckle.

How did you not see this coming? Let’s break down just some of market headwinds we have seen over the last two months; the end of QE2, lingering effects of the Japanese earthquake and tsunami, a growing European sovereign debt crisis, and increasingly negative U.S. economic data points. Just how bad were those U.S data points? How about a Q1 GDP revision down to .4% and Q2 GDP coming in at whopping 1.3%? Let’s not forget the July ISM number plummeting to 50.9%, its lowest reading since August of 2009. Sprinkle in some truly dreadful employment numbers and you have a surefire recipe for disaster. Anyone who is blaming this on the debt ceiling debate is fooling themselves. There’s a reason companies are sitting on oodles of cash and not hiring. There’s a reason why companies have been conservative with their Q3 guidance. The world’s economy is slowing down. We need to accept this as fact and allocate capital accordingly.

So with all that doom and gloom how can I possibly recommend investing in equities? Look, things are bad, but the world is not ending. Even if we slip into another recession, the S&P doesn’t need to trade down to 900. Companies are still making money and equities are the only investment with any chance of generating alpha. This correction has brought stocks back to reality. I still don’t think stocks are cheap but at these levels I am willing to put some money to work.

Check out the stocks I selected here

Thursday, August 4, 2011

Down goes Frazier!

This is too funny to pass up.

If you can't laugh on days like this, you wont make it in this game.

Tuesday, August 2, 2011

T20YM Update: Let the Market Correct

It’s been roughly six months since I made my case for Best of Breed dividend stocks. Since that time, I have let the portfolio run dripping the dividends and re-balancing quarterly. I have taken a brief hiatus from writing for multiple reasons. First and foremost, I was immersed in school work and honestly had no time to analyze individual companies or sectors. Second, and perhaps more importantly, I did not trust the markets sustainability. I could not honestly recommend individual stocks at their current valuations. Sure earnings season went off without a hitch, but these results were inflated by an economy buoyed by the Feds easy money policy. The fact of the matter is that the economic data points over the last quarter have been abysmal.

We got ahead of ourselves, the market needs this correction.

Personally, I hope we break the S&P 500 1249 support. This will give the market a complete flush out that it needs.

I plan on writing an update on my Best in Breed Dividend Stock series shortly. The portfolio has outperformed the market admirably.

Keep your powder dry. Better to miss a few up days than throw money at a sinking ship.

We have more pain coming.

Best,

C

Sunday, May 29, 2011

Sunday, April 24, 2011

Sorry for the lack of activity...

Hey All…

Sorry for the lack of posting. Finals are coming up and its crunch time. I should be back online in early May with some new posts.

I played the AAPL earnings through GLW, QCOM, and a small Bull Spread in AAPL June Calls. As you can expect I did rather well.

Back to the books!

C

Friday, April 8, 2011

Time to Reflect

When I started the T20YM venture, I had a clear and concise goal; to make money using a disciplined investing strategy centered on Dividend Growth Investing coupled with option trading on momentum stocks. For the past year, this strategy has been inconsistent. There were months where I would be up 30-40%, and months where I was down 30-40%. As it stands today, I have zero dollars left in my equity account. I liquidated my positions and all that remains are my family’s long-term investments.

I have decided I am a skilled fundamental stock picker and investor, but a terrible ‘trader’. My long-term holdings were all sold for a profit. However, as a former semi-pro poker player, I have that no limit mentality. When I saw odds in my favor, I placed large bets- sometimes on margins- and when these trades went bad, things got ugly. Well, over the last few months things went really ugly. There’s and old adage ‘the market can remain irrational longer than you can stay solvent’. Well Mr. Market, you’ve won this battle but not the war.

Moving forward:

I will rebuild my Dividend Growth Portfolio using the ‘Best in Breed’ articles located in the links section. I will start by accumulating small, 50 share positions at a time. I will wait for pull backs in these names as I am in no rush to jump in at the markets current levels.

My option ‘trading’ will be severely minimized. I will not buy front month options. I will not buy large lots of options that grossly distort my weighting in certain sectors. I will use options to invest in companies that do not pass my dividend screening model. There is no need to hold common shares if you are not being paid to hold them.

So what went wrong? The past few months the market has gone up, but I got hammered. I rode AAPL shares from 362 down to 339. I was heavily leveraged with ‘deep in the money’ April calls looking to play the pre-earnings run up. Obviously, the market has not been kind to AAPL.

I-Pad 2 delays: False

Steve Jobs to Die in Six Weeks: False

I-Phone 5 Delay: False

Bomb scare called into packaging facility

Steve Jobs to permanently resign as CEO of AAPL: So far, False

Supply Chain constraints due to Japan disaster: no evidence

Thunderbolt outselling I-Phone: False

Middle East Turmoil, Higher Oil Prices: Affected the market over all.

Then the NASDAQ re-balances

Plus many, many, MANY more rumors….

The stock was tanking, even with a HUGE IPad2 and Verizon launch. I stuck with my investment thesis and kept riding the stock down. No matter the fundamentals, you can’t fight the market. I still think AAPL is a fantastic investment, check out this article I wrote for the fundamentals

So that’s it for now, back to basics. I will keep you updated as I add back to my Dividend Growth Portfolio. My holdings in my family portfolio as of right now are as follows:

FYI, my 401K remains unchanged… at least I got that going for me!

All the best,

C

Sunday, April 3, 2011

IBM: One of the Best Values on the Market

In Peter Lynch’s seminal work ‘One Up on Wall Street’ he quipped, ‘No money manager ever lost their job investing in IBM’. This was a backhanded compliment by Lynch. Lynch viewed IBM as a safe, but stodgy company. While it was true that IBM was a secure investment, no shareholder was getting rich by allocating capital to this tech juggernaut. IBM was the equivalent of investing in a low yield bond.

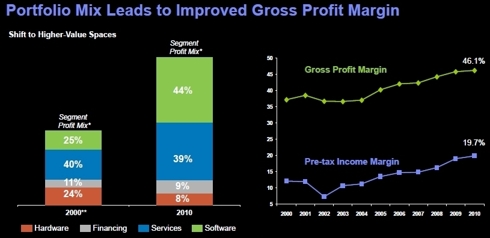

But over the last 7 years, IBM’s fundamentals have been progressively improving. These improvements are due in large part to management’s decision to focus on more profitable business segments. Unlike Dell (DELL) and Hewlett Packard (HPQ), IBM correctly identified the commoditization of the computer hardware market and quickly moved into higher profit margin spaces such as software and services. IBM summed this up perfectly at their recent shareholder meeting (click to enlarge):

Here we see a 10% GPM increase as IBM shifts to higher-value spaces.

In addition to adjusting their business focus, IBM has continued its global expansion. As they state in their recent annual report:

A historic economic expansion is underway in the emerging markets of the world—as their populations join the middle class and their economies join the global marketplace. These markets are expected to achieve average GDP growth of 5 percent through 2015, more than double the projected growth rate of the developed world. In the largest of these emerging markets, such as China, India and Brazil, IBM is broadening its well‑established base of skills and capabilities, nearly doubling our number of branch locations. In less developed markets, such as Africa, we are leveraging anchor clients in sectors like communications and banking. Our recent partnership with Bharti Airtel to provide 21st century wireless telecommunications across 16 countries of Sub‑Saharan Africa is one example. Our Growth Markets Unit accounted for 21 percent of IBM’s geographic revenue in 2010. We are aiming to approach 30 percent by 2015.

Read the rest of the article at Seeking Alpha IBM Growth, Dividends an Investors Dream

Wednesday, March 16, 2011

Apple, the most manipulated stock in the market.

16 March 11 Credit Suise initiates Apple to outperform. Target $500

11-Jan-11 Wells Fargo raised its FY11 EPS estimate to 19.33 from 18.24, and raised its FY12 EPS estimate to 22.89 from 22.42. Maintains an outperform rating on the stock.

11-Jan-11 Jefferies raises Apple target from $365 to $450.

05-Jan-11 Wedbush Securities stats Apple at outperform and $405 target.

04-Jan-11 added to short term buy list with $410 target at Deutsche Bank.

03-Jan-11 International Strategy and Investment Group raises target to $400

03-Jan-11 Oppenheimer raises target to $385

17-Dec-10 Trefis revises target from $400 to $418.

17-Dec-10 Gabelli initiates coverage at Buy with $450 target.

16-Dec-10 JP Morgan Chase raises price target to $420.

16-Dec-10 Kaufman Bros. raises price target to $395.

15-Dec-10 Piper Jaffray raises price target to $438.

14-Dec-10 BMO Capital raises price target from $330 to $355.

14-Dec-10 Morgan Stanley removes Apple from "Best Ideas" list, but maintained overweight rating and "Top Pick".

13-Dec-10 Goldman Sachs ups target price to $430.

10-Dec-10 Beyond Trading downgrades Apple from Strong Buy to Buy - not sure if BT is legitimate source??

09-Dec-10 BofA Merrill rates as buy raises to $420

08-Dec-10 Barclays Capital Analyst Ben Reitzes: Mac unit sales will surge 16% for the quarter ending in December, compared to the same period a year-ago

08-Dec-10 Stifel Nicolaus upgrade $390

04-Dec-10 Ebeling Heffernan Upgrade $400

03-Dec-10 Caris & Co. Upgrade $400

11-Nov-10 Trefis Upgrade $400 / $500

04-Nov-10 Robert W. Baird Initiated Outperform $410

03-Nov-10 Morgan Stanley "bull scenario" August 2011 target = $500

19-Oct-10 Argus Reiterated Buy $375

19-Oct-10 UBS Reiterate Buy $365

19-Oct-10 Canaccord Genuity Reiterated Buy $421

19-Oct-10 ISI Group Reiterated Buy $370

19-Oct-10 Kaufman Bros Reiterated Buy $380

15-Oct-10 Hudson Square Upgrade $500

12-Oct-10 Barclays Capital Reiterated Overweight $385

08-Oct-10 Oppenheimer Reiterated Outperform $345

05-Oct-10 Jefferies Initiated Buy $365

04-Oct-10 Ticonderoga Initiated Buy $430

Who the hell cares about JMP and his BS downgrade?

Fundamentals are unbelievable The Best Stock on Sale

11-Jan-11 Wells Fargo raised its FY11 EPS estimate to 19.33 from 18.24, and raised its FY12 EPS estimate to 22.89 from 22.42. Maintains an outperform rating on the stock.

11-Jan-11 Jefferies raises Apple target from $365 to $450.

05-Jan-11 Wedbush Securities stats Apple at outperform and $405 target.

04-Jan-11 added to short term buy list with $410 target at Deutsche Bank.

03-Jan-11 International Strategy and Investment Group raises target to $400

03-Jan-11 Oppenheimer raises target to $385

17-Dec-10 Trefis revises target from $400 to $418.

17-Dec-10 Gabelli initiates coverage at Buy with $450 target.

16-Dec-10 JP Morgan Chase raises price target to $420.

16-Dec-10 Kaufman Bros. raises price target to $395.

15-Dec-10 Piper Jaffray raises price target to $438.

14-Dec-10 BMO Capital raises price target from $330 to $355.

14-Dec-10 Morgan Stanley removes Apple from "Best Ideas" list, but maintained overweight rating and "Top Pick".

13-Dec-10 Goldman Sachs ups target price to $430.

10-Dec-10 Beyond Trading downgrades Apple from Strong Buy to Buy - not sure if BT is legitimate source??

09-Dec-10 BofA Merrill rates as buy raises to $420

08-Dec-10 Barclays Capital Analyst Ben Reitzes: Mac unit sales will surge 16% for the quarter ending in December, compared to the same period a year-ago

08-Dec-10 Stifel Nicolaus upgrade $390

04-Dec-10 Ebeling Heffernan Upgrade $400

03-Dec-10 Caris & Co. Upgrade $400

11-Nov-10 Trefis Upgrade $400 / $500

04-Nov-10 Robert W. Baird Initiated Outperform $410

03-Nov-10 Morgan Stanley "bull scenario" August 2011 target = $500

19-Oct-10 Argus Reiterated Buy $375

19-Oct-10 UBS Reiterate Buy $365

19-Oct-10 Canaccord Genuity Reiterated Buy $421

19-Oct-10 ISI Group Reiterated Buy $370

19-Oct-10 Kaufman Bros Reiterated Buy $380

15-Oct-10 Hudson Square Upgrade $500

12-Oct-10 Barclays Capital Reiterated Overweight $385

08-Oct-10 Oppenheimer Reiterated Outperform $345

05-Oct-10 Jefferies Initiated Buy $365

04-Oct-10 Ticonderoga Initiated Buy $430

Who the hell cares about JMP and his BS downgrade?

Fundamentals are unbelievable The Best Stock on Sale

Monday, March 14, 2011

Stock Analysis ExxonMobil Corp. (XOM) Current Yield 2.2%

ExxonMobil Corp. (XOM) Current Yield 2.2%

Exxon Mobil Corporation was incorporated in the State of New Jersey in 1882. Divisions and affiliated companies of ExxonMobil operate or market products in the United States and most other countries of the world. Their principal business is energy, involving exploration for, and production of, crude oil and natural gas, manufacture of petroleum products and transportation and sale of crude oil, natural gas and petroleum products. ExxonMobil is a major manufacturer and marketer of commodity petrochemicals, including olefins, aromatics, polyethylene and polypropylene plastics and a wide variety of specialty products. ExxonMobil also has interests in electric power generation facilities. Affiliates of ExxonMobil conduct extensive research programs in support of these businesses.

Exxon Mobil is not only the largest Major Integrated Oil & Gas Company, it is the largest publically traded company in America. It’s a low beta, safe investment. Because of its sheer size it has become increasingly more and more difficult for the management team to move the earnings needle. Nonetheless, the fundamentals of Exxon Mobil are superb:

ExxonMobil is part of the elite Dividend Champion list, increasing its dividend payments for 28 straight years. The yield of 2.2% is low, but with a payout ratio of 25.6% there is considerable room for growth. It has kept is Dividend Growth Rate steady at 8.7% for the last 7 years. The ROE and SGR numbers are well above average and best in breed. It has the best balance sheet of the group. It is currently trading at a premium to its historic P/E ratio.

Modeling ExxonMobil 10 year return using its EPS growth rate we arrive at a slightly above average return:

If you are looking for a safe and stable oil play ExxonMobil might be your best bet. Furthermore, with ExxonMobil improving fundamentals the market should soon begin to recognize these achievements.

All the best,

C

Saturday, March 12, 2011

Best in Breed Dividend Stocks: The Chase for Yield (Part 4)

Today we are going to stray from the sector theme and address a question that has been raised by many readers:

Where’s the yield?

As I have stated in previous articles, I'm a dividend growth investor, not a yield chaser. I believe in investing in undervalued companies, with moderate dividend yields, good dividend growth rates, low payout ratios and long-term sustainable business models. For younger investors, a disciplined dividend growth Investing plan is a sure fire path to financial freedom.

That being said, there is something attractive about stocks with substantial dividend yields. The idea of gaining 6-14% annually on a stagnant investment is hard to pass up. The problem with these investments is yields as lofty as these are rarely sustainable. When the dividend goes, so does the multiple the market has placed on the stock. Most of the time, the dividends you’ve accumulated on these high yielders will pale in comparison to the stocks decline when the dividend is compromised.

Still, there is a place in a well diversified dividend portfolio for the companies with abnormally high yields. These high yielders help smooth out the yield curve of a portfolio and push it above the 3% minimum yield I use as my benchmark. This allows us to take on companies with smaller yields and high growth rates, while keeping the income flowing.

Before we get to the picks, I am going to forewarn you that many of the metrics you are accustomed to reading about in my articles, such as Return on Equity, Sustainable Growth, EPS Growth Rate, and Dividend Payout Ratio have little, or nothing to do with the companies we will discuss. This is part of the reason I don’t usually invest in these companies. I don’t invest in equities I can’t accurately value. Master Limited Partnerships, Real Estate Investment Trusts, ETFs, and the like, play by their own rules.

Read the rest of the article here

Where’s the yield?

As I have stated in previous articles, I'm a dividend growth investor, not a yield chaser. I believe in investing in undervalued companies, with moderate dividend yields, good dividend growth rates, low payout ratios and long-term sustainable business models. For younger investors, a disciplined dividend growth Investing plan is a sure fire path to financial freedom.

That being said, there is something attractive about stocks with substantial dividend yields. The idea of gaining 6-14% annually on a stagnant investment is hard to pass up. The problem with these investments is yields as lofty as these are rarely sustainable. When the dividend goes, so does the multiple the market has placed on the stock. Most of the time, the dividends you’ve accumulated on these high yielders will pale in comparison to the stocks decline when the dividend is compromised.

Still, there is a place in a well diversified dividend portfolio for the companies with abnormally high yields. These high yielders help smooth out the yield curve of a portfolio and push it above the 3% minimum yield I use as my benchmark. This allows us to take on companies with smaller yields and high growth rates, while keeping the income flowing.

Before we get to the picks, I am going to forewarn you that many of the metrics you are accustomed to reading about in my articles, such as Return on Equity, Sustainable Growth, EPS Growth Rate, and Dividend Payout Ratio have little, or nothing to do with the companies we will discuss. This is part of the reason I don’t usually invest in these companies. I don’t invest in equities I can’t accurately value. Master Limited Partnerships, Real Estate Investment Trusts, ETFs, and the like, play by their own rules.

Read the rest of the article here

Monday, March 7, 2011

Wednesday, March 2, 2011

The Best Integrated Oil Company You Don't Know About: CNOOC

China National Offshore Oil Corporation, CNOOC (CEO)

(This is an older valuation I did for Seeking Alpha)

Today I would like to discuss one of the cheapest and most dominant energy companies in the world, CNOOC. Despite the lofty share price (hovering around 210 per share), the recent pullback in the stock has provided a decent entry point for the long-term investor.

What it Does:

CNOOC Limited, incorporated on August 20, 1999, is an investment holding company. The company, through its subsidiaries, is engaged in the exploration, development, production and sales of crude oil and natural gas and other petroleum products. It is a producer of offshore crude oil and natural gas. It has four production areas in offshore China, which are Bohai Bay, Western South China Sea, Eastern South China Sea and East China Sea. In addition, the company is also an offshore crude oil producer in Indonesia. The company also has upstream assets in Nigeria, Australia and some other countries. As of December 31, 2009, the company owned net proved reserves of approximately 2.66 billion barrels of oil equivalent (BOE), and its average daily net production was 623,896 BOE. Its subsidiaries include CNOOC China Limited, CNOOC International Limited, China Offshore Oil (Singapore) International Pte Ltd, CNOOC Finance (2002) Limited and CNOOC Finance (2003) Limited (per Reuters).

Read the full valuation at Seeking Alpha

(This is an older valuation I did for Seeking Alpha)

Today I would like to discuss one of the cheapest and most dominant energy companies in the world, CNOOC. Despite the lofty share price (hovering around 210 per share), the recent pullback in the stock has provided a decent entry point for the long-term investor.

What it Does:

CNOOC Limited, incorporated on August 20, 1999, is an investment holding company. The company, through its subsidiaries, is engaged in the exploration, development, production and sales of crude oil and natural gas and other petroleum products. It is a producer of offshore crude oil and natural gas. It has four production areas in offshore China, which are Bohai Bay, Western South China Sea, Eastern South China Sea and East China Sea. In addition, the company is also an offshore crude oil producer in Indonesia. The company also has upstream assets in Nigeria, Australia and some other countries. As of December 31, 2009, the company owned net proved reserves of approximately 2.66 billion barrels of oil equivalent (BOE), and its average daily net production was 623,896 BOE. Its subsidiaries include CNOOC China Limited, CNOOC International Limited, China Offshore Oil (Singapore) International Pte Ltd, CNOOC Finance (2002) Limited and CNOOC Finance (2003) Limited (per Reuters).

Read the full valuation at Seeking Alpha

Tuesday, March 1, 2011

Friday, February 11, 2011

Putting my Option Trading on Hold.

I have hit a bit of a cold streak on the option market. So for the time being I am putting my option trading on hold.

I am taking 6 classes this semester, and working a very intellectually intensive job. I dont have time to trade in and out of options during days.

I still believe in option trading, I just need to focus on school and work (and my lovely wife).

If the market is anything, it is humbling. Lately, I am a humble man.

Best,

C

I am taking 6 classes this semester, and working a very intellectually intensive job. I dont have time to trade in and out of options during days.

I still believe in option trading, I just need to focus on school and work (and my lovely wife).

If the market is anything, it is humbling. Lately, I am a humble man.

Best,

C

Monday, February 7, 2011

Best in Breed Dividend Stocks Title Fight: Coke Vs. Pepsi

In the latest installment of "Best in Breed Dividend Stocks: Core Holdings for the Long-Term Investor," I identified Pepsico, Inc. (PEP) as the Best in Breed stock in the Consumer Staples sector. This choice immediately ignited the age old debate: Coca-Cola (KO) or Pepsi? Let the cola wars began anew.

Judging by both the comment section and my inbox, choosing Pepsico over Coca-Cola is akin to being a Clippers fan in Los Angeles. You are in the right city, just rooting for the wrong team. Why would I build a franchise around Blake Griffin when I could have Kobe Bryant?

Before I take the bait, let me state the obvious. Coca-Cola and Pepsico are both fantastic companies. Any investor would be hard-pressed to find a more consistent long-term holding. I would love to own both of them, but I like to build a full position in one before jumping into another. Additionally, I think Pepsico offers a more attractive entry point at the moment.

Let’s run these two soft drink giants through the T20YM gauntlet:

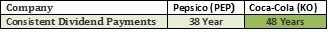

Round One: Consistent Long-Term Dividend Payments:

Both companies are part of the elite Dividend Champion Club, raising their dividend payments for over 25 years. Coca-Cola has a slight advantage in this category with 48 year of increases to Pepsico’s 38 years. Let’s be honest, both of these payment histories are impressive, putting both companies in the top 50% of American corporations on the list. Still, this round has to go to KO.

Read the whole article here: Seeking Alpha

Saturday, February 5, 2011

Best in Breed Dividend Stocks: Core Holdings for the Long-Term Investor, Part 2

In this installment we cover Consumer Staples, Technology and Industrials:

Consumer Staples

PepsiCo Inc. (PEP)

Current Yield: 3%

PepsiCo, Inc. manufactures, markets, and sells various foods, snacks, and carbonated and non-carbonated beverages worldwide.Popular products include Pepsi, Mountain Dew, Gatorade, Tropicana, Quaker Foods, Lay's Potato Chips, Doritos Tortilla Chips, Cheetos, Rold Gold Pretzels, and SunChips. It is an iconic brand operating virtually worldwide.

PepsiCo, Inc. is a member of the elite Dividend Champion list, increasing its dividend for 38 straight years. Its average dividend growth rate in the last seven years is 17.3% with a payout ratio of under 40%. This is one of the safest and most sustainable dividends in the market.

The fundamentals of PepsiCo, Inc. are downright exciting:

ROE in the last seven years is 33.4%, nearly three times the average. Likewise, the sustainable growth rate is 19.8%, nearly double the 10% SGR I look for in investments. PepsiCo, Inc. is currently trading at a P/E of 16.2, which is three points below its seven-year average.

When we model PepsiCo, Inc.'s future EPS using these metrics, the results are compelling:

Read the rest of Best in Breed Dividend Stocks: Core Holdings for the Long-Term Investor, Part 2 at Seeking Alpha

Subscribe to:

Posts (Atom)