I have hit a bit of a cold streak on the option market. So for the time being I am putting my option trading on hold.

I am taking 6 classes this semester, and working a very intellectually intensive job. I dont have time to trade in and out of options during days.

I still believe in option trading, I just need to focus on school and work (and my lovely wife).

If the market is anything, it is humbling. Lately, I am a humble man.

Best,

C

Friday, February 11, 2011

Monday, February 7, 2011

Best in Breed Dividend Stocks Title Fight: Coke Vs. Pepsi

In the latest installment of "Best in Breed Dividend Stocks: Core Holdings for the Long-Term Investor," I identified Pepsico, Inc. (PEP) as the Best in Breed stock in the Consumer Staples sector. This choice immediately ignited the age old debate: Coca-Cola (KO) or Pepsi? Let the cola wars began anew.

Judging by both the comment section and my inbox, choosing Pepsico over Coca-Cola is akin to being a Clippers fan in Los Angeles. You are in the right city, just rooting for the wrong team. Why would I build a franchise around Blake Griffin when I could have Kobe Bryant?

Before I take the bait, let me state the obvious. Coca-Cola and Pepsico are both fantastic companies. Any investor would be hard-pressed to find a more consistent long-term holding. I would love to own both of them, but I like to build a full position in one before jumping into another. Additionally, I think Pepsico offers a more attractive entry point at the moment.

Let’s run these two soft drink giants through the T20YM gauntlet:

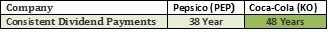

Round One: Consistent Long-Term Dividend Payments:

Both companies are part of the elite Dividend Champion Club, raising their dividend payments for over 25 years. Coca-Cola has a slight advantage in this category with 48 year of increases to Pepsico’s 38 years. Let’s be honest, both of these payment histories are impressive, putting both companies in the top 50% of American corporations on the list. Still, this round has to go to KO.

Read the whole article here: Seeking Alpha

Saturday, February 5, 2011

Best in Breed Dividend Stocks: Core Holdings for the Long-Term Investor, Part 2

In this installment we cover Consumer Staples, Technology and Industrials:

Consumer Staples

PepsiCo Inc. (PEP)

Current Yield: 3%

PepsiCo, Inc. manufactures, markets, and sells various foods, snacks, and carbonated and non-carbonated beverages worldwide.Popular products include Pepsi, Mountain Dew, Gatorade, Tropicana, Quaker Foods, Lay's Potato Chips, Doritos Tortilla Chips, Cheetos, Rold Gold Pretzels, and SunChips. It is an iconic brand operating virtually worldwide.

PepsiCo, Inc. is a member of the elite Dividend Champion list, increasing its dividend for 38 straight years. Its average dividend growth rate in the last seven years is 17.3% with a payout ratio of under 40%. This is one of the safest and most sustainable dividends in the market.

The fundamentals of PepsiCo, Inc. are downright exciting:

ROE in the last seven years is 33.4%, nearly three times the average. Likewise, the sustainable growth rate is 19.8%, nearly double the 10% SGR I look for in investments. PepsiCo, Inc. is currently trading at a P/E of 16.2, which is three points below its seven-year average.

When we model PepsiCo, Inc.'s future EPS using these metrics, the results are compelling:

Read the rest of Best in Breed Dividend Stocks: Core Holdings for the Long-Term Investor, Part 2 at Seeking Alpha

Subscribe to:

Posts (Atom)