In Peter Lynch’s seminal work ‘One Up on Wall Street’ he quipped, ‘No money manager ever lost their job investing in IBM’. This was a backhanded compliment by Lynch. Lynch viewed IBM as a safe, but stodgy company. While it was true that IBM was a secure investment, no shareholder was getting rich by allocating capital to this tech juggernaut. IBM was the equivalent of investing in a low yield bond.

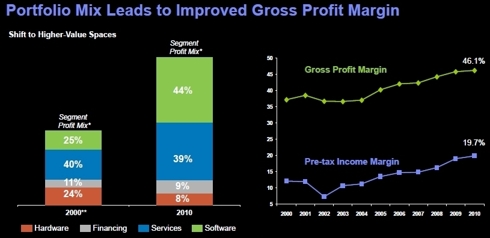

But over the last 7 years, IBM’s fundamentals have been progressively improving. These improvements are due in large part to management’s decision to focus on more profitable business segments. Unlike Dell (DELL) and Hewlett Packard (HPQ), IBM correctly identified the commoditization of the computer hardware market and quickly moved into higher profit margin spaces such as software and services. IBM summed this up perfectly at their recent shareholder meeting (click to enlarge):

Here we see a 10% GPM increase as IBM shifts to higher-value spaces.

In addition to adjusting their business focus, IBM has continued its global expansion. As they state in their recent annual report:

A historic economic expansion is underway in the emerging markets of the world—as their populations join the middle class and their economies join the global marketplace. These markets are expected to achieve average GDP growth of 5 percent through 2015, more than double the projected growth rate of the developed world. In the largest of these emerging markets, such as China, India and Brazil, IBM is broadening its well‑established base of skills and capabilities, nearly doubling our number of branch locations. In less developed markets, such as Africa, we are leveraging anchor clients in sectors like communications and banking. Our recent partnership with Bharti Airtel to provide 21st century wireless telecommunications across 16 countries of Sub‑Saharan Africa is one example. Our Growth Markets Unit accounted for 21 percent of IBM’s geographic revenue in 2010. We are aiming to approach 30 percent by 2015.

Read the rest of the article at Seeking Alpha IBM Growth, Dividends an Investors Dream

IBM is one of a few tech companies of the last century thats still around.

ReplyDelete