In the latest installment of "Best in Breed Dividend Stocks: Core Holdings for the Long-Term Investor," I identified Pepsico, Inc. (PEP) as the Best in Breed stock in the Consumer Staples sector. This choice immediately ignited the age old debate: Coca-Cola (KO) or Pepsi? Let the cola wars began anew.

Judging by both the comment section and my inbox, choosing Pepsico over Coca-Cola is akin to being a Clippers fan in Los Angeles. You are in the right city, just rooting for the wrong team. Why would I build a franchise around Blake Griffin when I could have Kobe Bryant?

Before I take the bait, let me state the obvious. Coca-Cola and Pepsico are both fantastic companies. Any investor would be hard-pressed to find a more consistent long-term holding. I would love to own both of them, but I like to build a full position in one before jumping into another. Additionally, I think Pepsico offers a more attractive entry point at the moment.

Let’s run these two soft drink giants through the T20YM gauntlet:

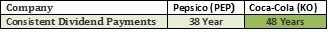

Round One: Consistent Long-Term Dividend Payments:

Both companies are part of the elite Dividend Champion Club, raising their dividend payments for over 25 years. Coca-Cola has a slight advantage in this category with 48 year of increases to Pepsico’s 38 years. Let’s be honest, both of these payment histories are impressive, putting both companies in the top 50% of American corporations on the list. Still, this round has to go to KO.

Read the whole article here: Seeking Alpha

Here is a current sheet of 8 stocks from the soft drink industry with best dividend yields. In total, 18 stocks are listed within the industry having a total market capitalization of USD 321 billion. ++ http://t.co/FNyCShK ++

ReplyDeleteCoke and pepsi are both of good quality.

ReplyDeleteThis is a nice post in an interesting line of content.Thanks for sharing this article, great way of bring such topic to discussion.

ReplyDelete